Active vs. Passive Management in Preferred Securities

Destra Capital

January 20, 2026Active vs. Passive: Why Professional Management Matters in Preferred Securities

As preferred securities gain renewed attention from advisors seeking income and diversification, an important question often follows: Should preferreds be accessed through an active or passive approach?

At a high level, preferred securities may appear similar to other income-oriented asset classes. But beneath the surface, they are structurally complex instruments where security-level features, issuer behavior, and market dynamics can materially affect outcomes. These characteristics are why many advisors view preferreds as an asset class where active management may play a meaningful role.

These takeaways reflect themes discussed throughout the article.

Preferred Securities Are Structurally Complex

Unlike traditional bonds or equities, preferred securities come with a wide range of embedded features that can influence both income and risk. These may include:

- Call provisions and redemption features

- Fixed-to-float or reset-rate structures

- Perpetual maturities

- Issuer-specific regulatory considerations

- A variety of positions within a company’s capital structure

Two preferred securities with similar coupons may behave differently depending on these factors. Passive strategies, by design, typically allocate based on index rules rather than security-level nuance which means structural risks may not be actively managed as market conditions change.

Call Risk and Income Stability

One of the most important considerations in preferred securities is call risk. Issuers may redeem preferred securities when it is economically advantageous to do so, particularly in changing interest-rate environments.

Active managers can evaluate:

- Whether a security is trading near its call price

- The likelihood of a call based on issuer incentives

- How call dynamics may affect portfolio income over time

In contrast, passive exposure may continue to hold securities regardless of call probability, potentially introducing reinvestment risk at inopportune times.

Credit and Sector Concentration Matter

Preferred securities are often issued by financial institutions such as banks, insurance companies, and utilities. While many of these issuers carry investment-grade ratings on their senior debt, preferred securities sit lower in the capital structure and therefore carry different risk characteristics.

Active management allows for:

- Ongoing issuer credit analysis

- Adjustments to sector exposure as conditions evolve

- Risk-aware positioning across different issuer types

Passive strategies may inherit sector concentrations dictated by issuance trends rather than forward-looking risk assessment.

Tax Characteristics Require Deliberate Selection

Another frequently overlooked aspect of preferred securities is their tax treatment. Certain preferred securities may distribute income eligible for Qualified Dividend Income (QDI) treatment, depending on structure and holding period. Others may be taxed as ordinary income.

Active managers can:

- Identify securities more likely to generate QDI-eligible income

- Balance tax considerations alongside income objectives

- Focus on what is actually distributed, not just what may be eligible

Passive approaches typically do not differentiate based on tax characteristics, which may matter for taxable client portfolios.

As Market Conditions Change—Indexes Can Stay Too Rigid

Preferred securities can be sensitive to:

- Interest rate movements

- Regulatory changes

- Issuer capital decisions

- Shifts in investor demand for income

Active management provides flexibility to respond to these changes—adjusting positioning, managing risk, and seeking opportunities that may not be reflected in static index construction.

Passive strategies, by contrast, are designed to track current index constituents as they are, and they are normally not able to adapt quickly to how markets evolve.

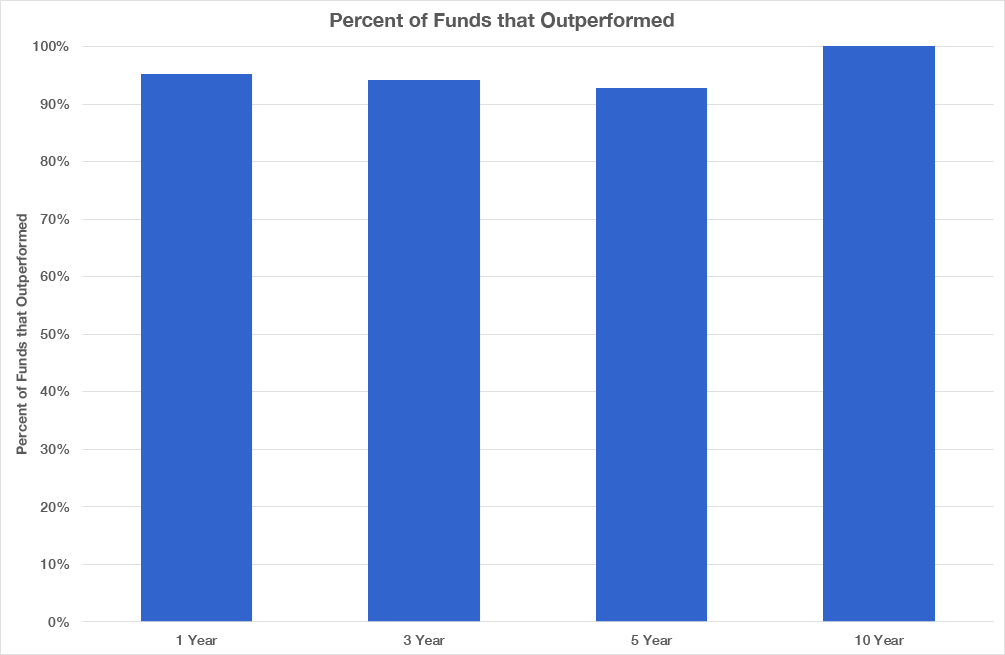

Proof Point: Consistency of Active Outperformance Over Time

Source: Morningstar as of 12/31/25. Actively managed preferred funds includes both open-end mutual funds and ETFs. Number of actively managed funds for the 1-year period equals 21. Number of actively managed funds for the 3-year period equals 17. Number of actively managed funds for the 5-year period equals 14. Number of actively managed funds for the 10-year period equal 9. Index being represented is the ICE BofA Fixed Rate Preferred Total Return USD.

The chart above illustrates the percentage of actively managed preferred funds that outperformed the index across 1-, 3-, 5-, and 10-year time horizons. Rather than highlighting isolated outcomes, this perspective focuses on persistence, how often active management may have added value relative to passive exposure across full market cycles.

Across all measured periods, a large majority of active strategies outperformed the index, with outperformance rates remaining above 90% in the 1-, 3-, and 5-year periods, and reaching 100% over the 10-year horizon. These results may suggest that active management in preferred securities has historically delivered competitive outcomes not only in shorter windows, but also across extended holding periods.

This pattern is notable given the structural characteristics of the preferred market. Index construction often results in exposure to securities based on issuance size and outstanding market value, rather than forward-looking assessments of call risk, credit dynamics, or interest-rate sensitivity. Active managers, by contrast, have discretion to evaluate these factors on an ongoing basis, which may influence relative outcomes over time.

Importantly, this analysis does not rely on a single market event or short-term period. Instead, it reflects potentially repeatable results across multiple horizons, reinforcing the idea that active management in preferred securities has historically been associated with a higher likelihood of outperforming index-based exposure.

While past performance does not guarantee future results, the consistency shown in the chart highlights why many advisors view preferred securities as an asset class where professional management may play a meaningful role.

How Advisors Think About Implementation

For advisors, the question is often less about choosing active or passive in isolation, and more about determining where professional discretion adds value.

Preferred securities are an asset class where:

- Structural complexity matters

- Security selection can influence outcomes

- Risk management is as important as income generation

For these reasons, many advisors consider active management a practical approach when incorporating preferred securities into client portfolios.

Looking Ahead

Understanding the role of active management is a key step in evaluating preferred securities. In the next part of this series, we’ll explore how advisors think about implementing preferred securities within portfolios, including use cases for income-focused and tax-aware clients.